This year’s East York housing market has been a rollercoaster ride of “crazy prices” and subsequent comedowns. Next year should see prices stabilize, realtors expect.

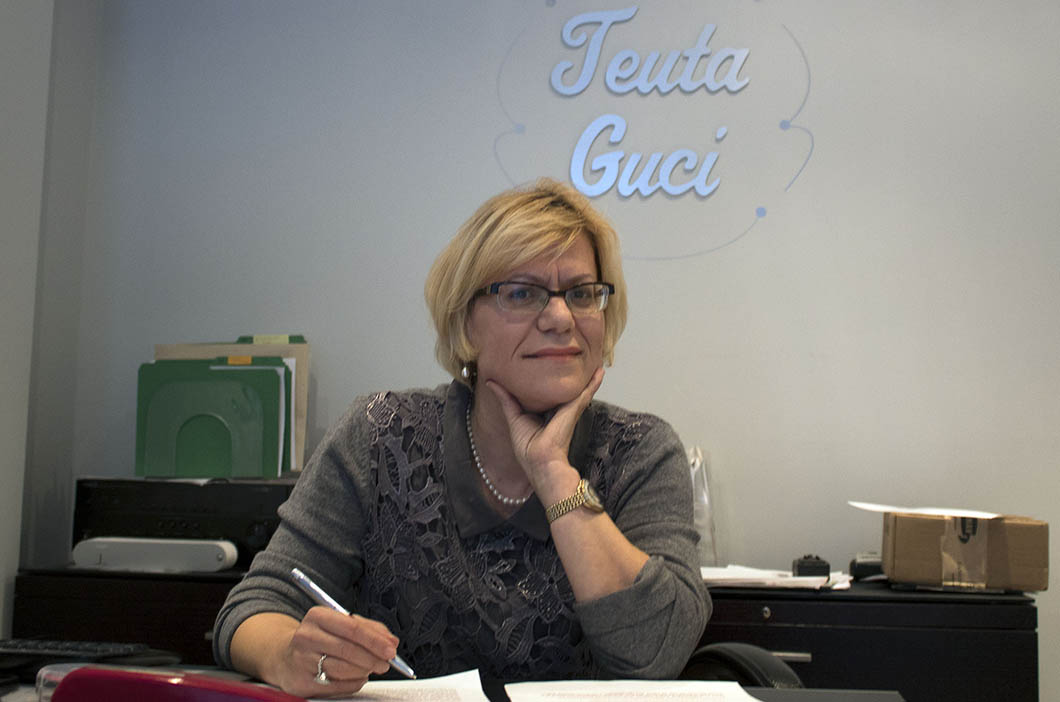

“We had a very strong market, but it still fluctuated during 2017,” said Teuta Guci, a realtor who has been providing service in the Danforth area for 10 years.

As with much of the Greater Toronto Area, house sales in East York were brisk at the beginning of the year, buoyed in part by owners moving here from their downtown condos. Three-bedroom semi-detached houses were the most sought after, according to reports from the Toronto Real Estate Board.

That demand began to wane in April after the provincial government introduced its Fair Housing Plan, which included a 15-per-cent foreign-buyers tax.

Buyers “stopped bidding” widely and lost their motivation to buy, Guci said.

“We saw so many houses come into the market. It created a glut with a downward-price adjustment,” she said. “Also, banks started to project that the market would go down.”

The slump continued through the summer. But by the final months of 2017, there have been indications the market is on its way up.

In November, TREB recorded 7,374 transactions in Toronto. That’s up from October. It’s also a 37.2-per-cent year-over-year increase, defying the regular seasonal trend.

The average selling price for November was $761,757. That’s down compared to the year-to-date average of $827,608.

The fall season has brought “an uptick in demand” for ownership housing in the GTA, TREB president Tim Syrianos said in a press release. Homebuyers might be snatching things up before changes to the mortgage-lending guidelines by financial regulator kick in, he said.

Due to take effect on Jan.1, 2018, the updated mortgage-stress test – aimed at ensuring that borrowers can pay back their loans in case the interest rate goes higher than their actual mortgage rate — will include a test for those with uninsured loans.

Guci believes the effect will be temporary. By February, she said, homebuyers will have assessed the situation. She predicts that the market will be more stable, with home prices possibly going up by at least 5 per cent.

“It’s not going to affect anything for 2018,” Guci said. “Toronto has lots to offer. We still have a lot of buyers, professionals.”

As for East York, she said it will continue to be a popular area for homebuyers because of its proximity to downtown and easy access to highways, subway stops, and trendy shops and restaurants.

“It’s going to be a really great year,” she said.