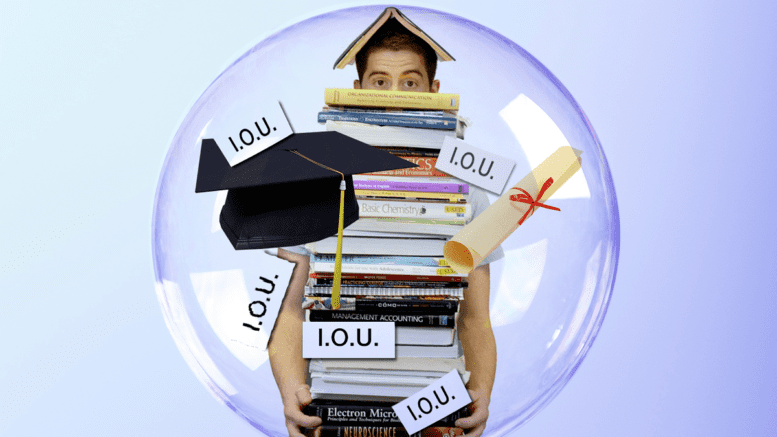

Two bachelor degrees from the universities of Waterloo and Toronto took Phil Durant five years to complete — five years of racking up his federal student debt. Since he came from a lower-income family, Durant had no choice but to take the loans.

“Students who come from lower-income backgrounds don’t want to get it but have no choice,” he says. “It’s unfair, and it sets them back, and it doesn’t make sense to me that it should be the case because more than likely the students would be working in Canada.”

In his three years at U of T, his loan reached the maximum of weeks and his interest started coming in. Durant was paying an estimate of around $100 a month just from interest.

Now 38 years old and a teacher assistant, he’s still paying off his student loans.

And the only relief he’s received from the federal government is Prime Minister Justin Trudeau’s promise to waive student debt interest for another year.

“Students are tired of unfulfilled promises,” says Nicole Brayiannis, national deputy chairperson of the Canadian Federation of Students in an article released by CFS.

“Budget 2021 revealed that over $2 billion has yet to be spent from student relief allocated over one year ago,” the article said. “We need the government to follow through on commitments to support students by listening to calls to expand relief funding, reintroduce moratoriums and relieve student debt, and invest in us as the future of this country.”

Student loans a ‘lucrative business’

On Aug. 28, NDP leader Jagmeet Singh charged “Trudeau has profited off student debt, to the tune of nearly $4 billion interest payments.”

Based on the 2019 to 2020 Canada Student Financial Assistance Program statistical review by the Government of Canada, the $22.3 billion loan portfolio remains a stable and lucrative business, increasing seven per cent in value from the previous year.

The overall amount of students who took from this loan portfolio is around 1.8 million Canadian students, 599,971 are currently studying, and 983,826 are paying back the loans.

There are 213,420 students in default for failing to pay their loans back in time.

The repayments start six months after students finish school or reduce from full-time to part-time studies. It also includes when a student leaves school or takes time off school.

Students have two interest rate options to choose from at the time of repayment. A floating interest rate equaled to the prime rate or a fixed interest rate of the prime rate two per cent.

Under Trudeau, the federal government reduced debt interest to zero percent in April to help students with flexibility during the pandemic.

“I’m glad about the freeze,” Durant says. “At least it will give me time to pay off some debt before the interest accumulates again.”

According to the National Student Loans Service Centre, the government has suspended the accumulation of interest on student loans until March 31, 2023.

Students in need of further aid for their loans can seek the Repayment Assistance Plan(RAP)